Volkswagen Faces New Chip Shortage Crisis: Production Halts for Golf and Tiguan

October 2025 – Just when the automotive industry thought it had left semiconductor shortages in the rearview mirror, Volkswagen is once again grappling with a critical chip crisis. This time, however, the culprit isn't a pandemic—it's geopolitics.

The Crisis Unfolding

Volkswagen has warned employees of production disruptions at major plants, with models like the Golf and Tiguan facing temporary production halts. The German automotive giant's iconic Wolfsburg plant, home to the legendary Golf, has been particularly impacted by this latest supply chain disruption.

The production halt stems from a supply chain issue involving chip supplier Nexperia, triggered when the Trump Administration pressured the Dutch government to take control of the Netherlands-based company in September 2025, citing intellectual property concerns related to the company's Chinese ownership.

The Nexperia Standoff

At the heart of this crisis is Nexperia, a Dutch chipmaker owned by Chinese company Wingtech Technology. After the Dutch government invoked its "Accessibility of Goods Act" to seize control of Nexperia and removed the company's CEO, China retaliated by imposing export restrictions on Nexperia products, creating a perfect storm for European automakers.

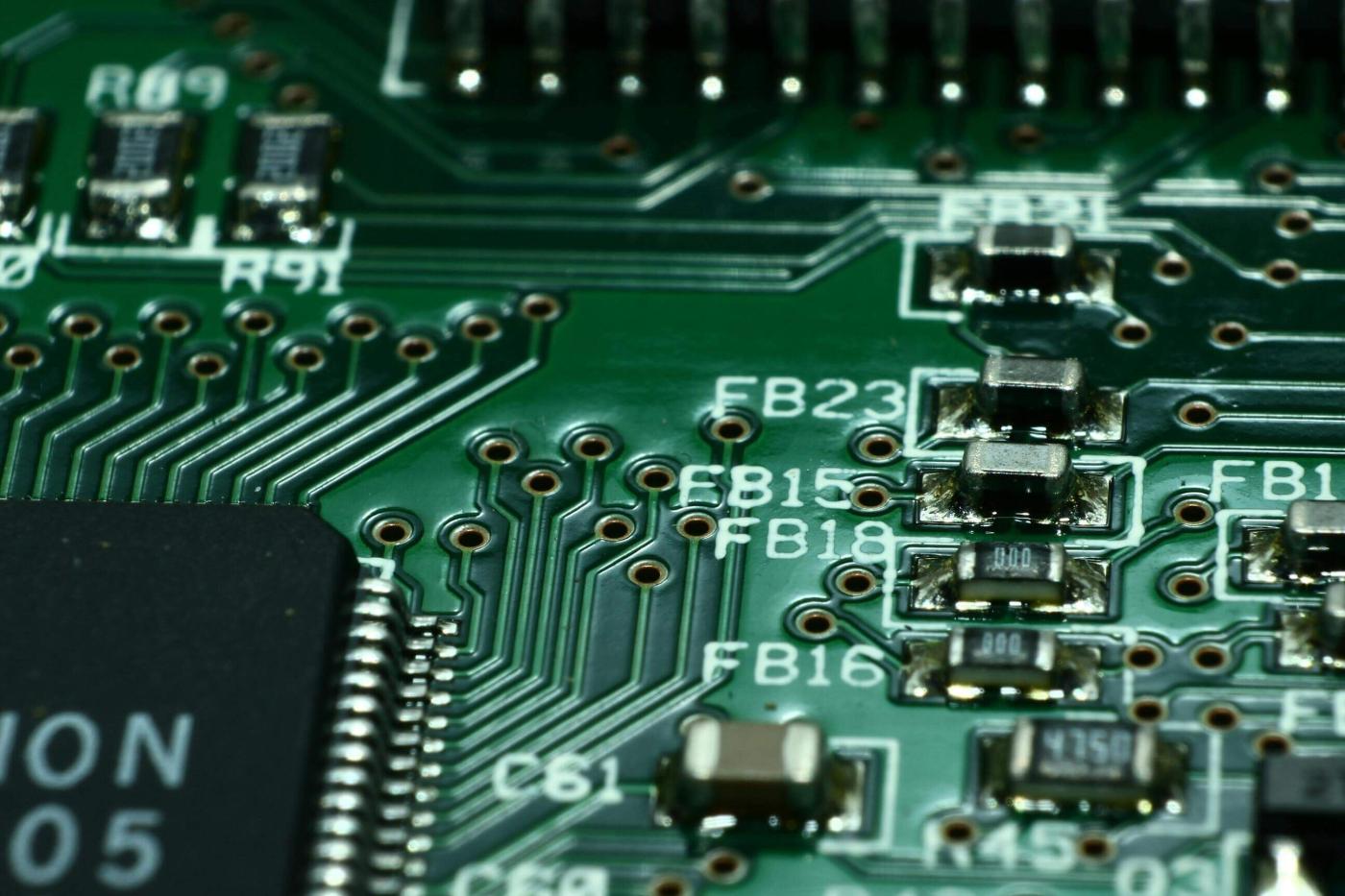

These aren't just any chips—Nexperia manufactures standard semiconductors like diodes and transistors that are installed in virtually every modern vehicle, used in engine control units, window regulators, LED lighting, driver assistance systems, airbag systems, and battery management in electric cars.

Impact Across Volkswagen's Lineup

The shortage has far-reaching implications:

Immediate Production Stoppages:

- Golf (including GTI and Golf R variants)

- Tiguan compact SUV

- Touran

- Tayron

The automaker has not specified when production might resume, and production interruptions at the Emden, Hanover, and Zwickau factories are also not ruled out.

A Different Crisis from 2020

Unlike the pandemic-era chip shortage that paralyzed the industry from 2020 to 2023, this crisis has a geopolitical foundation. During COVID-19, the issue was demand miscalculation and supply chain disruption. Now, it's trade tensions and strategic technology control that threaten production lines.

Volkswagen does not source Nexperia components directly, but rather through suppliers such as Bosch, Aumovio, and Valeo, whose inventory levels are only sufficient for a few more weeks.

Volkswagen's Response Strategy

The German automaker isn't standing idle. Volkswagen has pledged $2 billion to develop new Europe-based semiconductor plants by 2027, aimed at reducing its reliance on foreign chipmakers and stabilizing production long-term.

The company is also:

- Exploring partnerships with European suppliers

- Working closely with German and EU officials

- Reducing dependence on Nexperia

- Closely monitoring the semiconductor market

Broader Industry Implications

Volkswagen isn't alone in this predicament. BMW and Mercedes-Benz are working with suppliers to secure production of more chips, as the entire European automotive sector faces similar vulnerabilities.

Analysts warn that European companies could lose billions of dollars in production, potentially leading to higher car prices and delayed releases of new electric vehicles and hybrids—a particularly concerning prospect as the industry races toward electrification.

What This Means for Consumers

For consumers and car owners, this shortage could translate into:

- Extended Wait Times: Deliveries of popular models like the Golf and Tiguan may be delayed

- Price Increases: Supply constraints typically drive up vehicle prices

- Limited Availability: Certain configurations or trim levels may become harder to find

- Parts Concerns: The ripple effect may impact spare parts availability for repairs

The Road Ahead

Although Volkswagen expresses confidence that operations might resume in a few weeks, the bigger picture suggests there may be more uncertainty. The resolution depends heavily on diplomatic negotiations between China and the Netherlands, factors largely outside the automotive industry's control.

This crisis underscores a harsh reality: in our interconnected global economy, automotive production is vulnerable not just to pandemics and natural disasters, but to the shifting tides of international relations. For Volkswagen and its competitors, the lesson is clear—supply chain resilience and regional diversification aren't just business strategies; they're survival imperatives.

As the situation continues to evolve, one thing remains certain: the automotive industry's transition to a more stable, self-sufficient semiconductor supply chain can't come soon enough.